Peking University, Nov.9, 2011: On November 5, Nobel Prize Laureate in Economics Roger Myerson, Professor of University of Chicago, visited Guanghua school of Management (GSM) with his latest research A Model of Moral-Hazard Credit Cycles. The lecture was hosted by Professor Cai Hongbin, Dean of GSM.

Professor Myerson constructed a model of credit cycles driven by moral hazard in financial intermediation. Investment advisers or bankers must earn moral-hazard rents, but the cost of these rents can be efficiently spread over a banker’s entire career, by promising large back-loaded rewards if the banker achieved a record of consistently successful investments. The dynamic interactions among different generations of bankers can create equilibrium credit cycles with repeated booms and recessions. He also found conditions when taxing workers to subsidize bankers can increase investment and employment enough to make the workers better off.

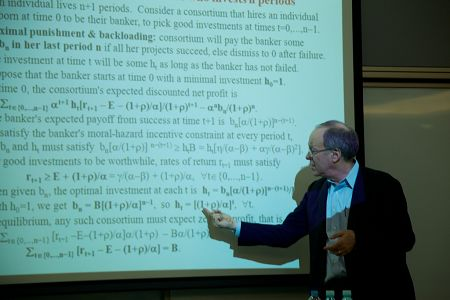

Prof. Myerson giving his lecture

Faculty members and students from the Department of Applied Economics interacted with Professor Myerson during his lecture.

Professor Roger Myerson was born in 1951, Boston, now he is a professor at the University of Chicago. His research areas include game theory in economics and the voting system in politics, etc. In 2007, Professor Myerson, with Leonid Hurwicz and Eric Maskin, won Nobel Prize in Economics due to their contribution to "Mechanism Design Theory".

Written by: Shi Hui

Edited by: Liu Lu

Source: PKU News (Chinese)